Compliance Report

- Licensed corporations are required to submit their audited accounts and other required documents, such as audit disclosure documents, business review management questionnaire (“BRMQ”), and financial resources returns (“FRR”) within four months after the end of each financial year (section 156(1) of the SFO).

- If a licensed corporation ceases carrying on all of the regulated activities for which it is licensed, it should submit to the SFC its audited accounts and other required documents, made up to the date of cessation, not later than four months after the date of the cessation.

Financial resources returns (“FRR”)

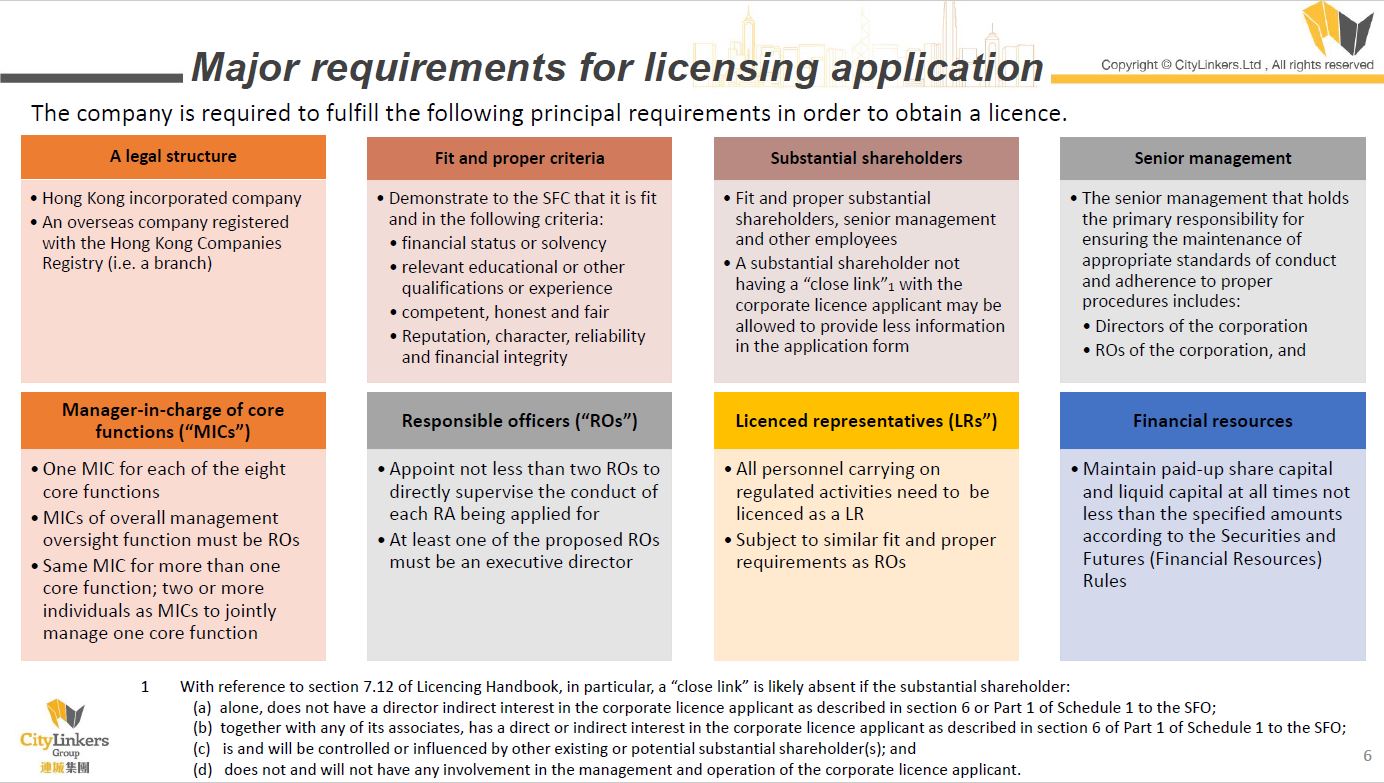

- According to section 56 of the Securities and Futures (Financial Resources) Rules, licensed corporations are required to submit monthly financial resources returns to the SFC. However, corporations that are licensed only for Type 4, Type 5, Type 6, Type 9 and/or Type 10 regulated activities and whose licenses are subject to the condition that they shall not hold client assets, are only required to submit semi-annual financial resources returns.

- Auditors are required to give an opinion as to whether the financial returns referred to in paragraph 87 which have been submitted to the SFC have been correctly compiled from the records of the licensed corporation, or if not correctly compiled, the nature and extent of the incorrectness. This involves auditors in examining the licensed corporation's compilations by reference to the Financial resources returns (“FRR”).

- Auditors are required to report whether the regulated entity has satisfied the requirements of the Securities and Futures (Keeping of Records) Rules during the period under review. In order to report on whether the regulated entity has satisfied the requirements of these rules it is envisaged that consideration will be given to whether adequate systems for control of the regulated entity's accounting systems have been maintained.

- Certain licensed corporations do not receive or hold client money or client securities either by choice or by limitation of their licensing condition. It would therefore not normally be necessary for auditors to make reference to the client asset rules in the Compliance Report. However, the auditors would ensure that such licensed corporations have procedures in place to avoid receipt or holding of client assets.

- We perform the audit of your license corporation and express an audit opinion whether the financial statements are in accordance with the records kept under Securities and Futures (Keeping of Records) Rules and satisfy the requirements of the Securities and Futures (Account and Audit) Rules.

- As above mentioned, we also conduct the audit to compile the compliance report whether your licensed corporation has satisfied the rules of keeping of records, Account and Audit, and client security or money.

- Also, we review the documents prepared by your licensed corporation, including business review management questionnaire (“BRMQ”), Financial Resources Report (“FRR”), audit questionnaire and account disclosure documents.

We also provide the following services: