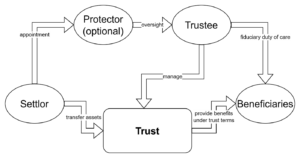

Trusts are legal arrangements that allow a person or entity, the "trustee," to hold and manage assets on behalf of another person or group of people, known as the "beneficiaries."

An important feature of a trust is the separation of legal ownership (trustee) and beneficial ownership (beneficiaries). The settlor transfers the legal and beneficial title of the assets to the trustee who in turn holds the legal title, or the legal ownership of these assets on behalf of and for the benefit of the beneficiaries who are beneficial owners.

The beneficiaries do not hold legal title to the assets that are settled on trust. Trusts are commonly used for estate planning, asset protection, and managing charitable donations.

An important feature of a trust is the separation of legal ownership (trustee) and beneficial ownership (beneficiaries). The settlor transfers the legal and beneficial title of the assets to the trustee who in turn holds the legal title, or the legal ownership of these assets on behalf of and for the benefit of the beneficiaries who are beneficial owners.

The beneficiaries do not hold legal title to the assets that are settled on trust. Trusts are commonly used for estate planning, asset protection, and managing charitable donations.

Key Elements of Trusts setup in Hong Kong

Advantages of Trusts in Hong Kong

Asset Protection of Trusts in Hong Kong

Some trusts, such as irrevocable trusts, provide protection from creditors and lawsuits by placing assets beyond the reach of potential claimants.

Control and Flexibility of Trusts in Hong Kong

Trusts allow the settlor to retain control regarding how their assets are managed and distributed, even after their death. Also flexibility is provided in the distribution of assets based on the specific circumstances and requirements of the beneficiaries.

Probate Avoidance of Trusts in Hong Kong

Assets held in a trust can bypass the probate process, which can be expensive, lengthy and public; and therefore allowing easier transfer of assets to the beneficiaries after the settlor’s death.

Privacy of Trusts in Hong Kong

Different from wills, documents related to trusts generally remain private and do not become public record.

With the Trust Law (Amendment) Ordinance 2013, Hong Kong’s trust regime was modernized to improve the competitiveness of Hong Kong’s trust services and attract settlors to set up trusts in Hong Kong, where new provisions were introduced to enhance protection for beneficiaries and to provide settlors with reserved powers in respect of investment or asset management functions. Moreover, with the amendments, there is statutory protection from foreign laws of inheritance – such as forced heirship rules.

Trustees were also provided greater default powers to facilitate the effective administration of trusts.

Trusts can be set up in perpetuity and benefit from Hong Kong’s extensive network of double taxation agreements.

Trust or Company Service Provider (TCSP) licensee

CityLinkers is a Trust or Company Service Provider (TCSP) licensee, authorized to provide professional services in trust set up and administration as per the Trustee Ordinance (Cap. 29) (the “Trustee Ordinance”).

What CityLinkers trust services can do for you

- Evaluate your needs and formulate bespoke trust structures and solutions;

- Establish the trust in accordance to full compliance and reporting and disclosure requirements;

- Perform trust administration;

- Outsource assets to asset management institutions;

- Provide the full range of trust services such as accounting, taxation planning, liaison with beneficiaries, protectors etc.

CityLinkers can provide solutions regarding the following types of trusts

Discretionary Trusts

Discretionary Trusts are the most commonly used as they provide the highest degree of flexibility. The trustees of a discretionary trust are provided with significant powers as to how the trust fund may be invested and who and when beneficiaries may benefit, and how much. The beneficiaries form a ‘class’ and the trustee has the discretion to decide which beneficiary is entitled to a distribution from the trust, and the amount of such distribution. The settlor may inform the trustee of his or her wishes as guidance regarding the trust’s administration, however such guidance is not binding.

Fixed Interest Trusts

Fixed Interest Trusts can be created to provide income, capital or other benefits in a predetermined proportion to a specific beneficiary, either during their lifetime or until a certain event is reached (e.g. marriage or reaching a certain age). The trustees then distribute the trust fund to the settlor’s chosen beneficiaries; the trustees have no discretion over the distribution of assets.

Employee Benefits Trusts

Employee Benefits Trusts (“EBTs”) can assist employers to incentivise and reward employees through types of share option plans such as Employee Share Option Plans, Restricted Share Plans, or Restricted Share Unit Schemes. The choice of EBT will largely depend on the employer’s objectives and business plans, the existing and anticipated share structure of the company, any relevant legal and tax issues, and the number of intended beneficiaries. Using the company’s shares as incentive means that there is no need for an instant cash settlement onto trust and settlements can generally be made from surplus profits in the future.

Initial Public Offering Trusts (IPOs)

Prior to the listing of a company, Hong Kong business owners will generally hold a significant number of shares in the trading company through a holding company. In such cases, the Hong Kong business owner can create an IPO trust and then transfer the shares in the holding company (“Holdco”) to the trustee. As a result, the shares in the company to be listed (“Listco”) will be indirectly held by the trustee through the holding company, with the common understanding that once the trust is established, legal ownership and control will be passed to the trustees. There are tax benefits of the structure, which also provides a useful tool to limit the risks related to the business owner’s shareholding in Listco.

Private Trust Company (PTC)

A Private Trust Company (“PTC”) acts as a trustee to a specific trust or a group of connected trusts. The PTC may be limited by shares or by guarantee, and is not permitted to act as trustee ‘by way of business’, meaning that it cannot receive fee income from acting as trustee. A PTC may be preferable to some clients because it allows the settlor to retain certain degrees of control if they are not familiar or comfortable with the trust concept and do not wish to transfer assets to a professional trustee.

ORSO Schemes

All Hong Kong employers are required by law to participate in the Mandatory Provident Fund (“MPF”). In addition to the MPF, employers may also adopt an Occupational Retirement Scheme (ORSO), the rules of which are more flexible and are subject to trust deeds and/or governing rules. All trust deeds and rules must comply with the Occupational Retirement Schemes Ordinance. Implementing an ORSO may have certain merits for the employer such as tax relief regarding contributions made to a registered or exempted ORSO and providing incentives for attracting and retaining employees.

Charitable Purpose Trusts

A Charitable Purpose Trust is a discretionary trust which must be established for one of the following charitable purposes:

(a) enhancement of education;

(b) poverty alleviation;

(c) advancement of religion; or

(d) other purposes of a charitable nature beneficial to the community not falling under any of the preceding heads.

Any of the first three activities may be undertaken in any jurisdiction however purpose (d) must be located in Hong Kong.

Hong Kong trust law generally does not recognize non-charitable purpose trusts.